One Park Financial: Faster capital without depending on SBA financing

Sun | December 2025

Small businesses face a complex financing landscape in 2025. While SBA loans remain valuable, recent regulatory changes and lengthy approval processes have made alternative business financing increasingly essential for entrepreneurs who need capital quickly.

Click the image below and watch our video to discover one of the key differences between SBA loans and other options like One Park Financial.

The SBA loan challenge in 2025

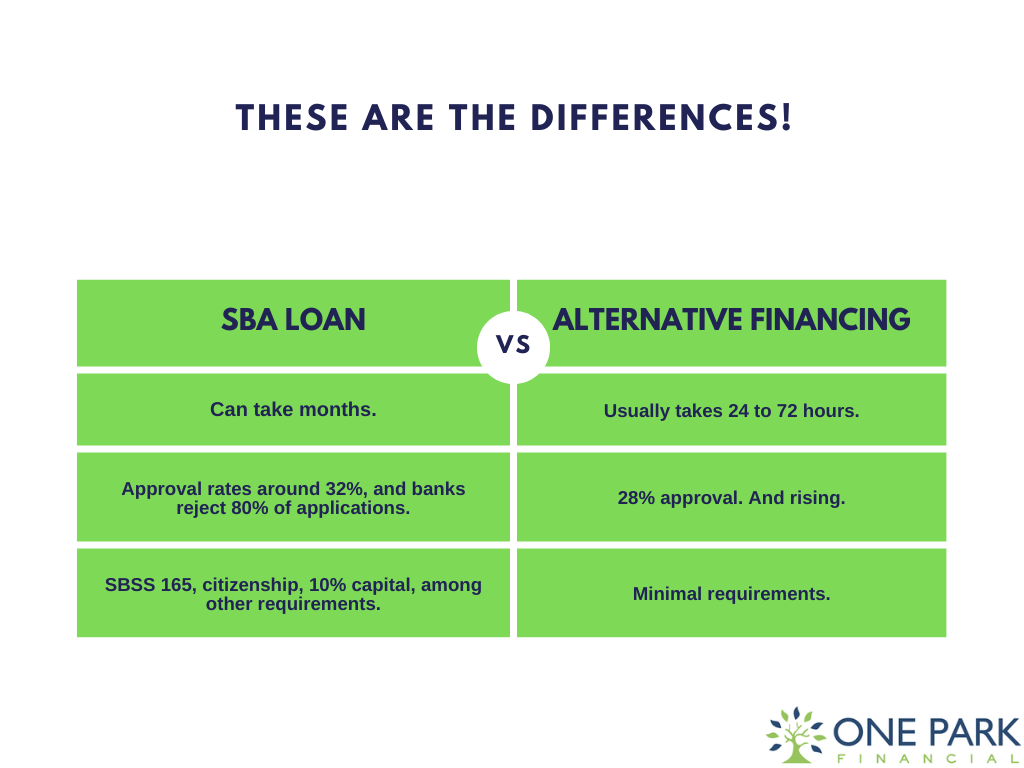

According to LendingTree's analysis of official SBA data, the agency provided $37.8 billion in 7(a) and 504 funding in fiscal year 2024, approving over 70,000 loans with an average size of $443,097. However, according to the 2025 Report on Employer Firms from the Federal Reserve Banks, only 32% of SBA loan applicants were fully approved in 2024.

On April 22, 2025, the SBA issued Standard Operating Procedure (SOP) 50 10 8, introducing substantial changes effective June 1, 2025. According to law firm Whiteford, Taylor & Preston, these revisions "largely reinstate pre-2021 underwriting criteria" and represent "a broader return to more rigorous eligibility standards."

Key changes include stricter ownership requirements (100% of owners must be U.S. citizens or lawful permanent residents), mandatory 10% equity injections for startups, higher credit score thresholds (SBSS score of 165 or more for expedited processing), and reinstated documentation requirements including tax transcript verification.

Beyond SBA loans, traditional bank financing remains challenging. According to research cited by iBusiness Funding, "banks reject around 80%" of small business loan applications. The typical SBA loan process can take several months from application to funding—time many growing businesses simply don't have.

Alternative business financing: A growing solution

As traditional lending has tightened, alternative financing has experienced remarkable growth. According to market research cited by Canopy, the global small business lending market is expected to grow at a compound annual growth rate of 13% from 2024 to 2032, reaching $7.22 trillion, driven largely by digital lending solutions from non-bank lenders.

Research cited by Defacto shows that 78% of small businesses now use at least one non-bank financing option. According to CRS Credit API's 2024 industry analysis, "alternative lenders had the highest loan approval rates as of March 2024, accepting over 28% of small business loan applications in the United States. Big banks had the lowest acceptance rates."

How One Park Financial serves small businesses

One Park Financial, a Miami-based financial services company founded in 2010, specializes in connecting small and medium-sized businesses with working capital solutions. According to Crunchbase, the company "offers financial services that connect merchants with the most diverse and experienced private business lenders," providing funding ranging from $5,000 to $500,000, including to businesses with credit scores as low as 500.

According to the company's LinkedIn profile, One Park Financial "helps small business owners access working capital" and has been voted a Top Workplace in South Florida from 2017 through 2022 and certified as a Great Place to Work for five consecutive years.

Streamlined access to capital

According to One Park Financial's FAQ, the company facilitates working capital through a simplified process with minimal requirements: at least 3 months in business and $7,500 in gross monthly revenues. The company offers a simple one-page application rather than extensive documentation, and can facilitate funding in as little as 24-72 hours.

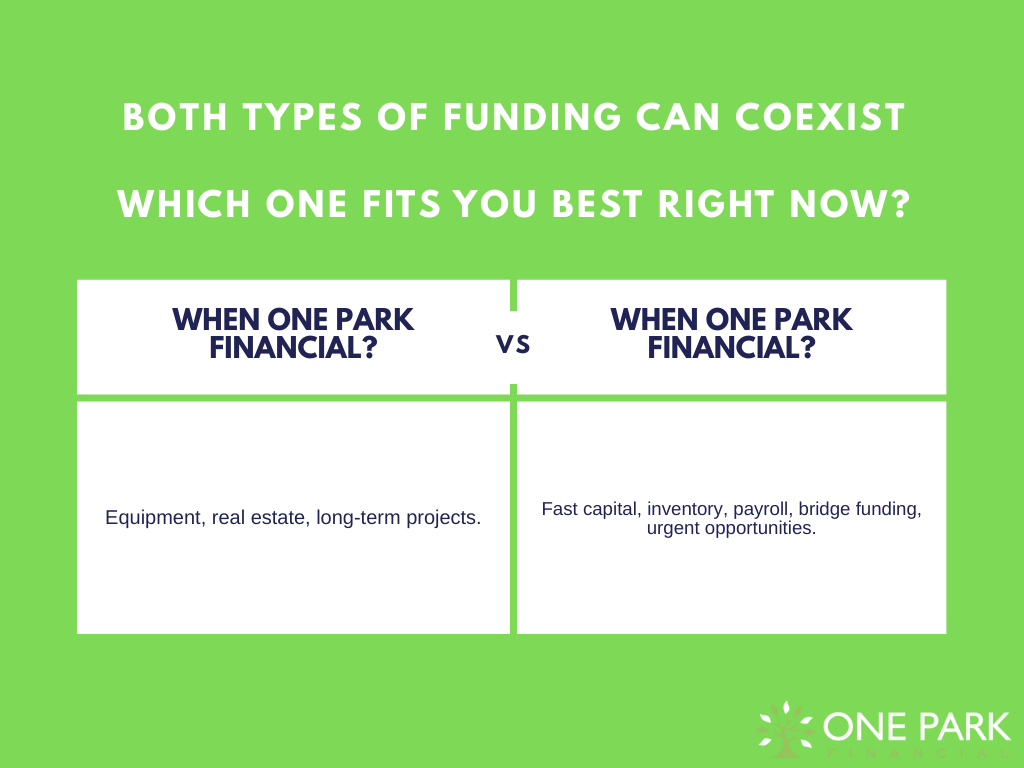

Businesses can use working capital for inventory, payroll, taxes, or expansion. According to the company's FAQ, "you do not incur a fee to start the process or review any funding option," with a professional service fee charged only if funding is secured. The company serves Puerto Rico and all U.S. states except California and New York.

A complementary approach to business financing

One Park Financial doesn't compete with SBA loans—it complements them. Many successful businesses use multiple financing sources for different purposes. An SBA loan might fund long-term equipment or real estate, while One Park Financial provides working capital for inventory, bridge financing during seasonal fluctuations, or quick funding for time-sensitive opportunities.

Making informed financing decisions

According to the 2025 Report on Employer Firms, 37% of small businesses applied for financing during a 12-month period. The most successful businesses understand that different capital sources serve different purposes and evaluate options based on timing requirements, qualification criteria, use of funds, total costs including opportunity costs, and operational impact.

According to Bankrate's analysis, this fiscal year 2025 would be "the biggest year in SBA fundings on record," demonstrating strong demand for government-backed financing. However, with only 32% full approval rates and stricter requirements, alternative financing remains critical.

According to Bankrate's analysis, this fiscal year 2025 would be "the biggest year in SBA fundings on record," demonstrating strong demand for government-backed financing. However, with only 32% full approval rates and stricter requirements, alternative financing remains critical.

Grow faster by combining your options

The relationship between SBA loans and alternative financing is complementary, not competitive. One Park Financial has built its business on ensuring small and mid-sized businesses have access to capital—whether pursuing SBA loans, needing faster alternatives, or requiring supplemental funding alongside traditional financing.

As the financing landscape evolves, access to capital fuels growth, and businesses that can secure funding quickly and efficiently have a competitive advantage. One Park Financial provides accessible, fast, flexible financing that works alongside and beyond traditional options, ensuring businesses with growth potential aren't held back by barriers to capital.

Sources cited in this article:

U.S. Small Business Administration official data and notices

Federal Reserve Banks' 2025 Report on Employer Firms

LendingTree analysis of SBA data (January 2025)

Bankrate SBA loan analysis (September 2025)

Whiteford, Taylor & Preston legal analysis

Byline Bank SOP 50 10 8 summary

iBusiness Funding research

Crunchbase company profiles

Canopy market research

Defacto research

CRS Credit API industry analysis (2024)

One Park Financial official materials and FAQ

This article is for informational purposes only and does not constitute financial advice.