How does inflation affect businesses and how to prepare?

Tue | October 2022

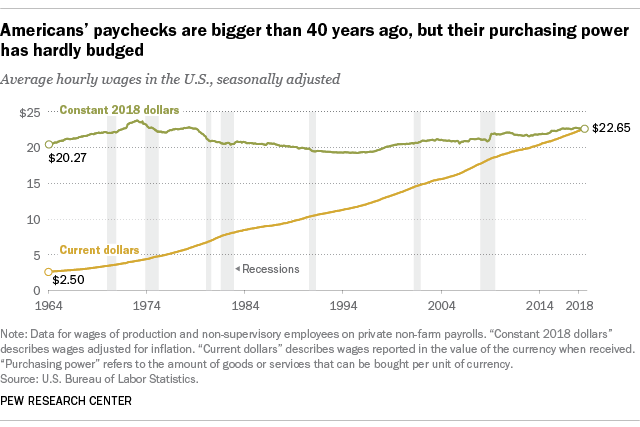

How does inflation affect consumers and businesses? Historically, rising inflation tends to decrease consumer purchasing power since the fixed value of their labor doesn’t generally follow the same trends as inflation. Add to that the compounding nature of inflation even on a month-to-month basis and over time; you’ll see what we’re experiencing today: decreased spending on non-essentials and increased prices for necessities.

“For most U.S. workers, real wages have barely budged in decades.”- Pew Research Center

“For most U.S. workers, real wages have barely budged in decades.”- Pew Research Center

Unless your business deals exclusively with essentials, you will likely see proportional profit drops. Even for essential suppliers, customers will probably begin cutting expenses, buying less frequently and in bulk, and splitting costs with others. But what can this mean for your business?

Inflation effects on businesses

Inflation does not affect all businesses equally. Nonessential goods and services, for example, are more vulnerable to the effects. Similarly, inflation is not always a bad thing. Many companies can emerge stronger than when they entered an inflationary period.

Below are some of the ways inflation can have negative and positive effects on businesses:

How does inflation affect businesses negatively?

Inflation can have consequences for a business, and not all of them are as obvious as "everything costs more," despite being near the top of the list. Many inflation effects result from buyers' emotional responses to rising inflation, which are unpredictable. Below are ways that inflation can be harmful to businesses:

Higher costs, fewer products: 89% of small-business owners have had to increase the price of their products or services, while 31% have discontinued products.

Pricier shipping: 28% of companies reported increasing shipping costs due to rising service costs.

Higher interest rates: Can mean fewer investors and slower expansion for once burgeoning businesses

Supply shortages: When production slows down due to rising costs, even suppliers have to raise their prices to afford increased material costs.

Maintenance: 40% of businesses have struggled to maintain their properties and equipment.

How does inflation affect businesses positively?

Yes, inflation can be prejudicial to some businesses, but it is important to note that not all companies are affected equally. Those who can pass on higher costs to consumers by raising prices are less likely to be negatively impacted by inflation than those who cannot. Some common ways inflation affects businesses positively are the following:

Price increases can mean increased profit

When inflation hits supply chains hard, you may need to increase prices to maintain a positive bottom line. But if you already have to increase costs, then why not make sure to boost profits above pre-inflation levels? A great example of this is Netflix (NFLX): Although they’ve lost over a million subscribers due to (among other things) increased competition and a recent $2 hike for their various subscription tiers, they reported a 9% revenue increase for Q2 2022. This can be true, although scaled-down, for smaller businesses too.

Cheaper Debt

Ask any homeowner how they feel about rising inflation; many with mortgages will say they’re happy about their fixed-rate loans. That’s because as inflation decreases cash value, it becomes easier to pay off fixed-rate loans.

For example, if you locked in a 3.94% rate 30-year mortgage on a $100k home loan in 2019, then the over 15% inflation that’s occurred since means your actual interest rate becomes 3.49%.On top of that, your purchasing power increases by 15%, so long as your home’s value stays the same, then it’s technically worth 15% more than you paid, even though you’ll only have to pay the initial $100k rather than the actual value of $115k.

Now imagine that instead of a house, you got a piece of equipment, an office building, or a business loan with a fixed rate loan.

The latter effect is commonly known as appreciation, and the same applies not only to real estate but to any businesses with fixed-rate loans on any number of assets.

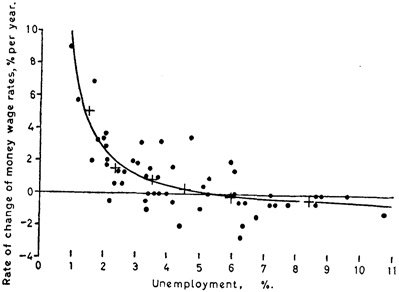

According to the Phillips Curve economic model, inflation goes up. This isn’t a law, but it’s a good general rule. It may take some time, especially as we near the tail end of the “Great Resignation.” Still, employers holding out for unemployment will likely see an increase in the pool of available and talented hires.

“Relationship between rate of change of money wages and unemployment in the years 1861-1913” - A figure from A.W. Phillip’s original paper

“Relationship between rate of change of money wages and unemployment in the years 1861-1913” - A figure from A.W. Phillip’s original paper

How to prepare your business

Small and mid-sized businesses are doing numerous things to keep up with inflation, from reducing workplaces and marketing costs to upgrading expense tracking software and hiring more accountants. There are many ways to hedge your bets against rising expenses, and finding a starting place is complicated or even a bit overwhelming. Below we've put together a list of strategies to deal with inflation in business:

Sell existing inventory at a higher markup

Dan, the owner of a medium-sized furniture store chain in the mountains of NC, saw the increased inflation coming months before it happened due to his relationships with various product suppliers. Knowing this, he doubled his usual inventory orders, biding his time by storing the surplus at his house for a few months. By the time inflation had reached his supply chain, he could justify selling all this extra stock at higher prices since all his competitors were increasing their costs due to supply chain issues. He made more profit and could sell at lower prices than his competitors, all while selling out faster than everyone else!

That’s not to say you should buy a DeLorean off of eBay and travel back in time to load up on cheap leather couches, because aside from the fact that doing so would be impossible (at least with modern technology), as Ken Fisher, investment analyst, author, and the founder and chairman of Fisher Investments, once said: “Time in the market beats timing the market.” However, suppose you’ve got spare inventory previously purchased at a lower cost. In that case, you can increase prices for these items far beyond your originally planned gross margin or perhaps sell them at a discounted rate, drawing customers away from your competitors.

Increase employee wages

A Harvard study cites the various benefits of increasing employee wages, including a greater than 1:1 productivity increase per dollar raise. For example, warehouse workers paid $11 per hour typically received reviews of “Poor” and “Fair” from their managers. In contrast, those receiving $17 per hour while working at the same company (but in different warehouses) not only received reviews of “excellent” nearly twice as often as their lower wage counterparts but also finished twice the number of projects (Emanuel and Harrington, 10).

Meanwhile, in the corporate world, tech giant Microsoft has run several successful experiments during the height of the COVID pandemic, in which they simultaneously reduced their employee’s work hours and raised their pay by 20%. This four-day workweek might be the next big thing, and companies implementing it have seen productivity increases of up to 40% without having to increase total payroll costs.

Plus, there’s the added benefit of increasing employee wages to the economy. When employees have more money to spend, they can return their money to businesses with their increased disposable income.

These strategies are easier to implement at big corporations. Still, small business owners can adapt and adjust winning concepts to fit their own needs – in the same way, that big business constantly looks to smaller companies to learn things such as how to make decisions faster and more efficiently.

Sooner than later - borrowing at fixed interest rates

As mentioned above, when interest rates and inflation increase, those with fixed-rate loans benefit from increased equity and decreased payments (compared to newer loans). That’s because any debt you’ve paid off can become an asset rather than a liability, especially if the item of purchase has been appreciated. If you believe inflation will continue to rise, even if you plan on selling your business before the loan date ends, getting a fixed-rate, long-term loan can seriously benefit you, if you’re qualified.

Have more than one supplier

Although it’s always a good idea to shop around for the best rates, it can become comfortable to stick with just one supplier if you enjoy working with them. But in times of severe inflation, many companies are hit harder than others with supply chain issues. If your favorite supplier suddenly raised their price higher than you can afford, you might spend a significant amount of time without supplies while looking for an alternative source. So, before this happens, experts recommend having at least 2-3 separate suppliers, even if you purchase most of your products or resources from just one. Relationships with different people in the same market sector can create a sort of safety net and even a little pricing competition, all to your benefit.

Surplus stock can cushion supplier changes

Even if you have relationships with other suppliers, it takes time to add your order to their list. If there’s a shortage, sudden price hike, or a random “black swan” type accident that forces you to switch to one of your other suppliers, it can help to have some stock to use during the time it might take for a different company to fill your order.

Expense consultants

Running a business can be exhausting, and sometimes it helps to hire someone who can do a particular one-time job for you while you’re out and about. Expense consultants can review your business’s operations, expenses, and productivity and suggest a plan to reduce operating costs while increasing efficiency. Some consultants even offer a service to assist in long-term planning by improving efficiency, finding more affordable suppliers, or even helping to manage low-level employees.

Prepare your business for every economic condition

Worry and uncertainty are frequently associated with periods of inflation. As you can see, there are many ways to hedge the ever-creeping threat of inflation while maintaining an upward profit trend. A prepared business can get a head start on the steps required to weather such a tumultuous period and emerge stronger — more efficient and productive — than before. As prices rise, so should a company's readiness to face a changing market head-on — and leave competitors behind. If you'd find this resource helpful, please share.

Disclaimer: The content of this post has been prepared for informational purposes only. It is not intended to provide and should not be relied on for tax, legal, or accounting advice. Consult with your tax, legal, and accounting advisor before engaging in any transaction.