Common mistakes business owners make when seeking capital

Sun | December 2025

Securing business funding can be the difference between growth and stagnation, yet many entrepreneurs sabotage their own success through avoidable mistakes. According to the Federal Reserve's 2025 Report on Employer Firms, 37% of small businesses applied for financing in the past year, but understanding common pitfalls can dramatically improve your chances of approval.

Click the image below and watch our video to learn more.

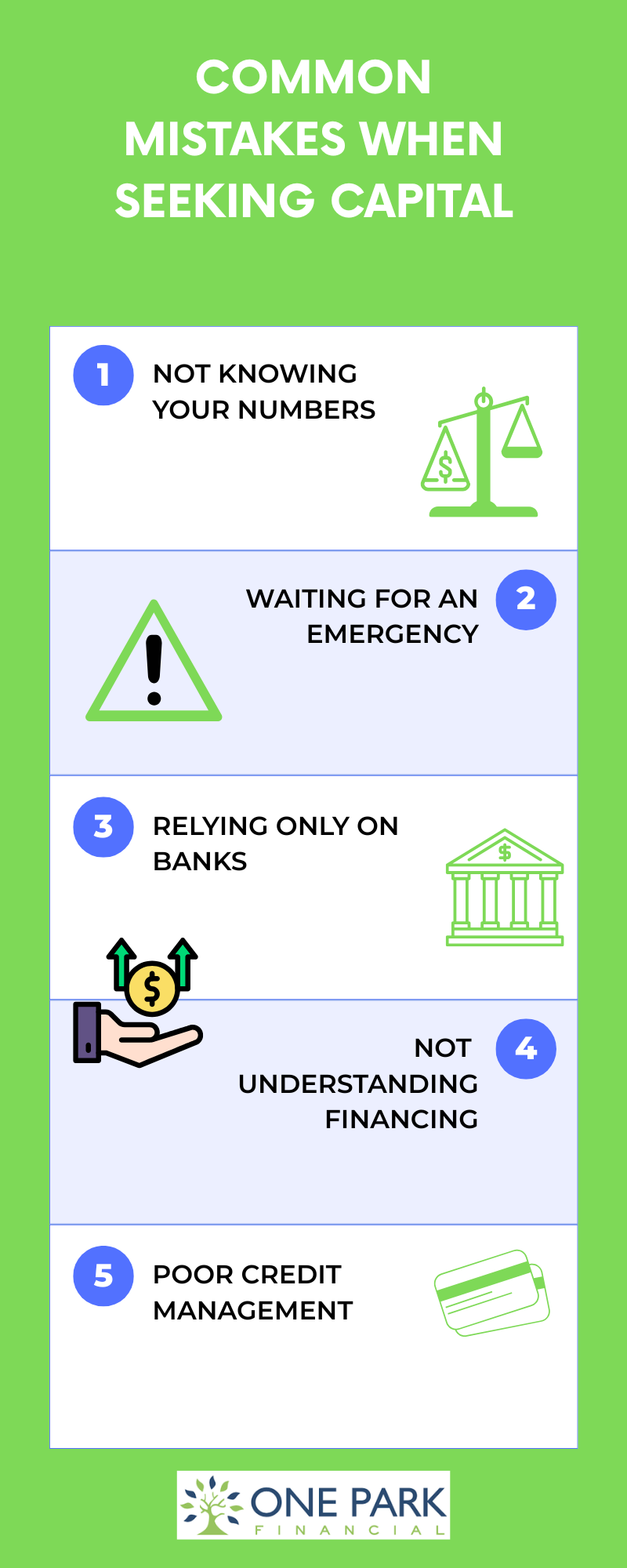

In the video above, you saw some of the most common mistakes business owners make when seeking capital. Below, you’ll find those mistakes listed out so you can review them anytime:

Mistake 1: Applying without knowing your numbers

According to the Federal Reserve Bank of Kansas City's Small Business Lending Survey, approximately 70% of lenders cited poor borrower financials as the primary reason for loan denials. Many business owners apply for funding without having clear financial statements, cash flow projections, or even knowing their exact revenue figures.

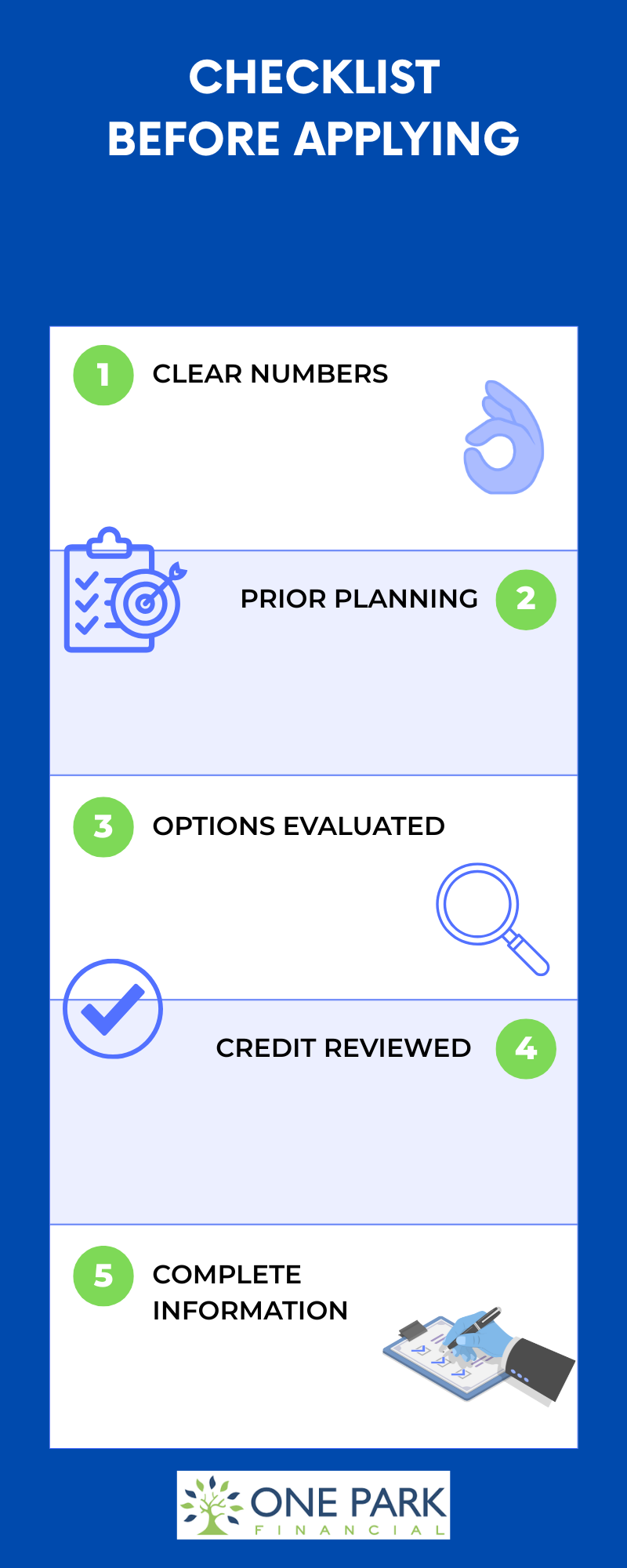

Before seeking capital, ensure you have: current profit and loss statements, balance sheets, cash flow statements, and realistic financial projections. One Park Financial works with businesses to understand their financial picture and match them with appropriate funding options based on actual business performance.

Mistake 2: Waiting until it's an emergency

Research shows that businesses seeking emergency funding face higher rejection rates and less favorable terms. According to industry data, proactive capital planning leads to better outcomes than crisis-driven applications.

Smart business owners secure working capital before they desperately need it, giving them negotiating power and better options. One Park Financial's streamlined process allows businesses to explore funding options proactively, with decisions in as little as 24-72 hours.

Mistake 3: Only considering traditional bank loans

According to CRS Credit API's 2024 analysis, big banks had the lowest loan acceptance rates, while alternative lenders accepted over 28% of applications. Yet many entrepreneurs waste months pursuing bank loans they're unlikely to receive.

According to research cited by Business Funding, banks reject around 80% of small business loan applications. Meanwhile, 78% of small businesses now use at least one non-bank financing option, according to industry research.

Mistake 4: Not understanding different funding types

Many business owners apply for the wrong type of financing. A merchant cash advance works differently than a term loan, which differs from a line of credit. Each has specific use cases, repayment structures, and qualification criteria.

One Park Financial specializes in educating business owners about various funding options and matching them with solutions that fit their specific needs, whether for inventory, payroll, expansion, or emergency expenses.

Mistake 5: Poor credit management

According to industry data, credit scores significantly impact approval rates and terms. Many entrepreneurs don't monitor their business credit or understand how personal credit affects business financing options.

However, alternative lenders consider factors beyond credit scores. According to One Park Financial's materials, the company works with businesses that have credit scores as low as 500, evaluating overall business health rather than credit alone.

Mistake 6: Incomplete or inaccurate applications

Lenders report that incomplete applications are among the top reasons for delays and denials. Missing documentation, inconsistent information, or errors can immediately disqualify otherwise qualified businesses.

One Park Financial simplifies this process with a streamlined one-page application focusing on essential information, reducing errors and speeding up the approval process.

The smart approach to seeking capital

The most successful business owners approach capital strategically: they maintain organized financial records, plan ahead rather than waiting for emergencies, explore multiple funding sources including alternative lenders, understand different financing types and their appropriate uses, manage credit proactively, and work with experienced partners who can guide them through the process.

According to Bankrate's analysis, 2025 is projected to be a record year for small business financing, but approval remains competitive. Avoiding these common mistakes can position your business for funding success.

Sources cited in this article:

Federal Reserve Banks' 2025 Report on Employer Firms

Federal Reserve Bank of Kansas City Small Business Lending Survey (Q2 2024)

CRS Credit API industry analysis (2024)

iBusiness Funding research

Bankrate SBA loan analysis (2025)

One Park Financial official materials

This article is for informational purposes only and does not constitute financial advice.