The Key Requirements for Getting a Business Loan in the U.S

Wed | February 2025

Getting financing for your business isn't just about needing money—it's about proving you can manage it wisely. Funders and financing programs consider multiple factors before approving any type of financing to determine the amount and its terms.

So, how hard is it to acquire a business loan or any sort of financing for your business? The answer depends on several key factors, including your credit history, business income, time in operation, and, in most instances, potential collateral.

The good news? You don't need to check every box perfectly. There are different business financing options available, some more flexible than others. In this article, we'll break down the four main factors funders assess and how you may improve your chances of approval.

1. Your Personal and Business Credit History

Funders use your personal and business credit scores as factors to assess how well you manage debt and the likelihood of repayment. A high credit score is especially important for traditional bank lenders like Wells Fargo or Bank of America.

Strong credit improves your chances of approval and impacts your loan terms. This includes the cost of capital in the form of interest rates (fixed or variable) or factor, and repayment periods (short- or long-term). Simply put, the better your credit, the better your business financing opportunities.

Now, let’s break down personal and business credit scores and how they affect your loan application.

Your Personal Credit Score

Your personal credit score (FICO), which you’re probably familiar with, reflects how well you’ve managed your finances. It helps funders predict your ability to repay the financing and assess your financial reliability.

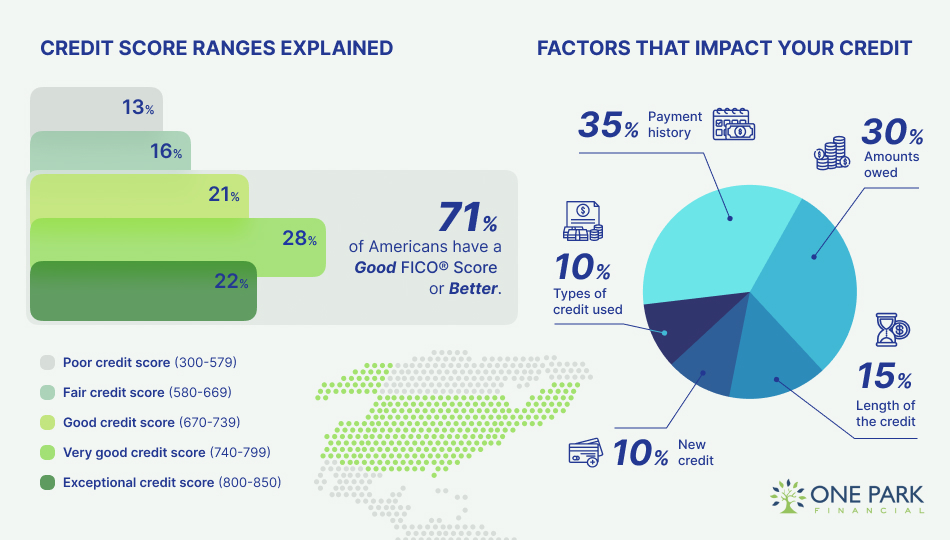

Credit agencies calculate this score based on the following factors:

Payment history: Have you paid your debts on time?

Total debt amount: How much do you currently owe?

Length of credit history: How long have you been using credit?

Types of credit used: Do you have a mix of credit types (credit cards, loans, credit lines)?

Below is a breakdown of credit score ranges and the key factors that impact your credit:

The chart above highlights the importance of credit scores in business financing decisions. However, some financing programs have more flexible requirements, and lenders consider additional factors—one of the most important being your business's revenue, which we'll discuss next.

So, if you were wondering, can I still get business financing with “bad” personal credit? The answer is yes! You don't need a perfect credit score to qualify for funding.

To help you compare options, here are the minimum credit score requirements from different lenders and financing programs:

Minimum Credit Score for Business Financing

Program | Minimum Personal Credit Score Required |

SBA Loans | 615-660 (depending on loan type) |

Wells Fargo Unsecured Line of Credit | 680 |

Bank of America (all types of business financing) | 700 |

American Express Business Line | 660 |

BlueVine | 625 |

Fundbox | 600 |

One Park Financial's Financing Programs | 500 |

Your Business Credit Score

Some lenders evaluate your business credit score and your personal credit, as it reflects your company's financial health. What's the difference between the two?

Personal credit score: Measures your individual credit reliability.

Business credit score: Measures your business’s credit reliability.

Just like personal credit, a higher business credit score lowers the lender's risk, making it easier to qualify for better financing terms. The most commonly used business credit rating models include:

Dun & Bradstreet PAYDEX → Scores from 0 to 100 (80+ indicates low risk).

FICO SBSS (Small Business Scoring Service) → Scores from 0 to 300 (minimum of 140 for SBA 7(a) loans).

Experian Intelliscore Plus → Scores from 0 to 100 (lenders prefer 76+).

Equifax Business Credit Report → Scores from 101 to 992 (most lenders require 570+).

Now is the perfect time to start if you've never checked your business credit score. A strong credit history can unlock financing opportunities and improve loan conditions.

For a step-by-step guide on how to build your business credit, check out our article: Build Business Credit: A Step-by-Step Guide for Entrepreneurs.

In the meantime, here are some of the most commonly used business credit reporting agencies so you can start monitoring your score:

Business Credit Reporting Agencies

Agency | Cost for Accessing Reports |

Dun & Bradstreet | Free limited reports: paid plans range from $15 to $30/month. A D-U-N-S® Number is required to establish your business credit. |

Equifax | Single reports: $99.95; Pack of five: $399.95. Free reports available if actively applying for credit. |

Experian | Annual plans: $199; Single report: $49.95. |

Nav | Free access to summaries; also offers tools to help build business credit. |

While your credit profile is important, it's not the only factor funders consider. In the next section, we'll explore why your business's cash flow and revenue are crucial—and how they impact your chances of financing approval.

2. Business Revenue

A growing or stable monthly revenue may offset other factors, such as a low credit score, because it shows that your business maintains a steady cash flow. Ultimately, every business needs to generate enough revenue to cover its debts, investments, and costs of operation, right? Funders analyze your revenue to assess how much your business earns and compare it to your expenses to determine your repayment capacity.

If your business is only one or two months old, getting financing can be tough unless you have a strong credit history. But you may still qualify for funding if you've been in business for at least three months and make $7,500 or more per month. Companies like ours offer flexible financing options with easy requirements to help small businesses grow.

Let’s look at some typical revenue requirements to understand better what’s needed:

Business Revenue Requirement

Program | Minimum Revenue Requirement |

SBA Loans | $50,000 in average annual revenue |

Bank of America Business Line of Credit | $100,000 in annual revenue |

American Express Business Line | $36,000 in annual revenue |

Fundbox | $30,000 in annual revenue |

BlueVine | $10,000 in monthly revenue |

One Park Financial | $7,500 in monthly revenue |

To prove your business revenue, you may need to provide the following documents:

Bank statements – Typically covering the last 3 to 12 months to confirm deposits so funders may analyze.

Profit and loss statement (P&L) – Summarizes revenue and expenses over time.

Invoices and receipts – Provide proof of recent sales and income.

Tax returns – Usually from the past one to two years to demonstrate consistent revenue.

Proof of Ownership - This may be your IRS letter, proving that you are the owner of the organization.

Having these documents ready will speed up the application process and show lenders that your business is financially stable.

However, revenue isn’t the only important factor. Lenders also consider the length of time your business has been operating. Next, we’ll explore why this matters and how it affects your financing options.

3. Time in Business

The time your business has been operating is another key factor that financing companies consider when evaluating your application. Why does it matter? Because it demonstrates stability. Suppose your business has been in the market for several years. In that case, it shows that you've overcome early challenges and built a solid foundation for growth. And, of course, the more stable your business appears, the less risky it is for lenders.

Just like credit score requirements (+660) and revenue criteria (at least $100,000 in annual revenue), most traditional lenders—such as banks—require your business to have been operating for at least two years, or even three in some cases.

If i have a startup, can I still apply?

If your business is still in its early stages, you may not qualify for financing from traditional institutions. But that doesn't mean you're out of options. The purpose of this guide is to help you explore all your options. Every great idea or business deserves an opportunity. If your business is new but growing steadily, there are financing companies willing to invest in your success.

Below, we've compiled a table with time-in-business requirements by lender so you can get a clearer idea:

Time in Business Requirement

Company | Minimum Time in Business Required |

SBA Loans | 2 years |

Bank of America Business Line of Credit | 2 years |

American Express Business Line of Credit | 1-2 years |

Fundbox | 6 months |

BlueVine | 12 months |

One Park Financial | 3 months |

Before applying, make sure you meet this key requirement. This will help you avoid surprises and focus on financing options that best suit your business.

So far, we've covered the importance of credit score, revenue, and time in business—but some lenders may also require personal guarantees or collateral. Let's take a closer look at what this entails and how it affects your financing options.

4. Personal Guarantees and Collateral

We're reaching the final part of our review of the key requirements for getting business financing. So far, you've seen that lenders evaluate businesses in different ways. Another factor that may come up in your search is a personal guarantee or collateral.

While not always required, understanding how it works can help you secure better terms or explore options that don't need it.

What is collateral? Collateral is an asset you can offer—such as vehicles, equipment, real estate, inventory, or accounts receivable—to secure a loan. What does this mean? In the event that you default on payments, the lender would then have the right to seize the asset to recover the investment lost. Since collateral reduces the lender's risk, secured loans (backed by assets) typically offer lower interest rates and longer terms.

What is a personal guarantee? Instead of requiring collateral, some lenders may ask you, as the business owner, to personally guarantee the loan repayment. This means that if your business cannot repay the financing, your personal assets—such as your home, savings, or vehicle—could be at risk in the event of a default.

Even if you registered your business as an LLC or corporation, you may still need to provide a personal guarantee, especially if your business is new or has a limited credit history. Lenders want to ensure you're willing to take responsibility for the loan.

What if I don't have collateral? Not all funders require guarantees. Alternative options, such as revenue-based financing, consider your business revenue primarily. In many cases, they also come with faster approval processes, as fast as 2 hours from application.

Below is a list of lenders and programs that do not require you to provide any guarantee:

Business Financing Without Collateral

Program | Business Financing Amounts |

One Park Financial | $5,000 - $500,000 |

Blue Vine | Up to $250,000 |

On Deck | $5,000 – $250,000

|

Fund Box | Up to $150,000 |

SBA 7(a) Loan Program | Up to $50,000 |

Collateral or not? The choice is yours. Now, you know that not all business financing options require a personal guarantee or collateral. What’s most important is choosing the option that best fits your business, repayment ability, and growth plans.

The key is understanding your possibilities and making a strategic decision.

Now that you have all this information let’s explore how you can prepare a strong loan application and increase your chances of approval.

Your Next Step Toward Business Financing

Accessing financing for your business may seem challenging, but now you understand the key factors lenders evaluate. Your credit history, revenue, time in business, and collateral (or lack thereof) can all influence your approval.

The key is to be well-prepared before applying. Here are some steps you can take to increase your chances of success:

Check your credit score and improve it if necessary.

Analyze your business revenue and cash flow—review your bank statements to understand your financial standing.

Verify how long your business has been operating—lenders may require business registration documents or tax filings as proof.

Determine if you can offer collateral or if you prefer unsecured financing options.

Research and compare financing options—this guide has provided several options to help you start your search.

The right financing can help your business grow and reach its goals. The next step is in your hands—take it with strategy! We wish you the best of luck!

Disclaimer: The content of this post has been prepared for informational purposes only. It is not intended to provide and should not be relied on for tax, legal, or accounting advice. Please consult with your tax, legal, and accounting advisor before you begin any transaction.