Advantages of alternative funding compared to traditional bank loans

Tue | December 2025

The small business financing landscape has fundamentally shifted. According to industry research cited by Defacto, 78% of small businesses now use at least one non-bank financing option. This massive adoption reflects real advantages that alternative funding offers over traditional bank loans—advantages that can make the difference between seizing opportunities and watching them pass by.

Click the image below and watch the video to learn more.

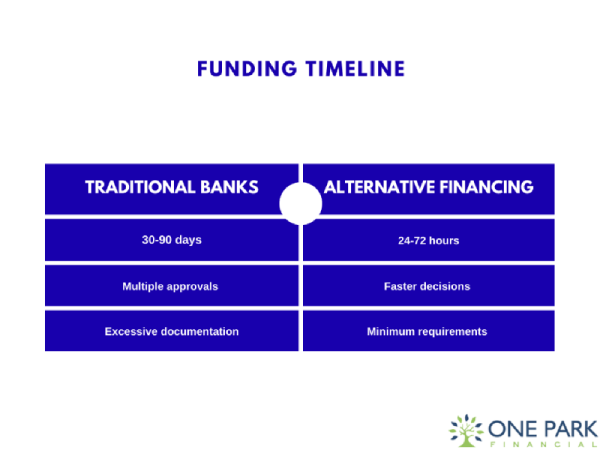

Speed: Days instead of months

Traditional bank loans typically require 30-90 days from application to funding, according to industry data. The SBA loan process can stretch even longer, with multiple rounds of documentation and approval.

Alternative funding through providers like One Park Financial operates on an entirely different timeline. According to the company's materials, businesses can receive funding in as little as 24-72 hours. This speed matters when you're facing time-sensitive opportunities like bulk inventory discounts, emergency equipment repairs, or seasonal hiring needs.

Accessibility: Higher approval rates

According to CRS Credit API's 2024 industry analysis, alternative lenders had the highest loan approval rates, accepting over 28% of small business loan applications in the United States. Big banks had the lowest acceptance rates.

Research cited by iBusiness Funding indicates that banks reject around 80% of small business loan applications. According to the Federal Reserve's 2025 Report on Employer Firms, only 32% of SBA loan applicants were fully approved in 2024.

Alternative lenders evaluate businesses differently, considering cash flow, revenue trends, and overall business health rather than relying solely on credit scores. One Park Financial works with businesses that have credit scores as low as 500, according to company materials.

Flexibility: Fewer restrictions on fund usage

Traditional bank loans often come with strict covenants and restrictions on how funds can be used. According to industry experts, banks may require specific collateral, personal guarantees, and detailed reporting on fund usage.

Alternative funding offers greater flexibility. According to One Park Financial's FAQ, businesses can use working capital for purchasing inventory, covering payroll, paying taxes, or expanding operations—without the restrictive oversight typical of traditional loans.

Simplified requirements: Less paperwork, faster decisions

Bank loans require extensive documentation: multiple years of tax returns, detailed financial statements, business plans, collateral appraisals, and more. According to industry sources, incomplete documentation is among the top reasons for loan delays and denials.

One Park Financial streamlines this process with a simple one-page application focusing on essential information: at least 3 months in business and $7,500 in gross monthly revenues. This simplified approach reduces errors and accelerates approvals.

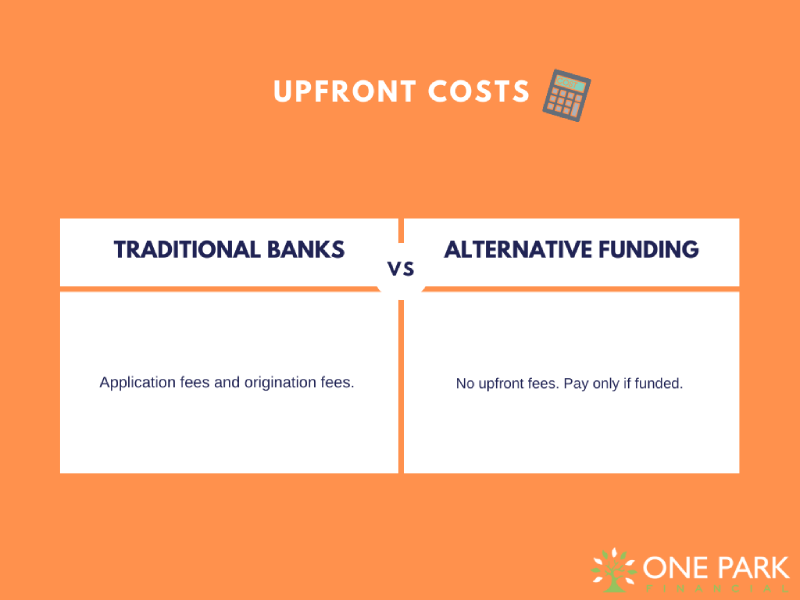

No upfront fees: Pay only for successful funding

According to One Park Financial's FAQ, businesses "do not incur a fee to start the process or review any funding option." A professional service fee is charged only when funding is successfully secured. This risk-free exploration allows business owners to understand their options without financial commitment.

Traditional bank loans may involve application fees, origination fees, and other upfront costs regardless of approval outcomes.

Geographic availability and inclusivity

While traditional banks may have limited branch networks or restrictive lending territories, alternative lenders often serve broader markets. One Park Financial offers financing in Puerto Rico and all U.S. states except California and New York, according to company materials.

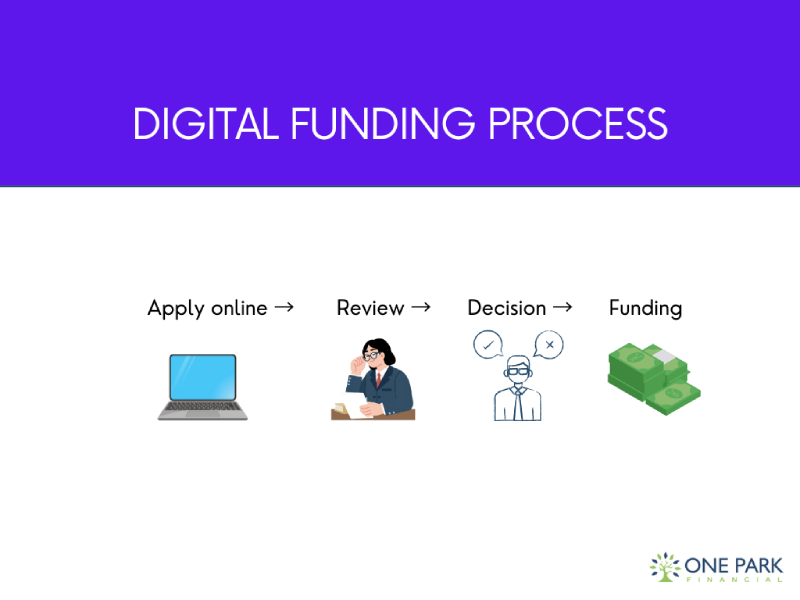

Technology-driven efficiency

The global small business lending market is expected to grow at a 13% compound annual growth rate from 2024 to 2032, reaching $7.22 trillion, according to market research cited by Canopy. This growth is driven largely by technology-enabled digital lending platforms.

Alternative lenders leverage technology to assess applications faster, reduce overhead costs, and pass savings to borrowers through competitive rates and streamlined processes.

When alternative funding makes sense

Alternative funding particularly benefits businesses that: need capital quickly for time-sensitive opportunities, don't meet strict bank requirements, have less than perfect credit, need flexibility in fund usage, want to avoid lengthy application processes, or seek working capital rather than large-term loans.

According to the 2025 Report on Employer Firms, 37% of small businesses applied for financing in a 12-month period, with many seeking amounts under $100,000. These smaller amounts are often better served by streamlined alternative lenders.

The complementary approach

Smart business owners don't choose between traditional and alternative funding—they use both strategically. A traditional bank loan might finance long-term equipment or real estate, while alternative funding handles immediate working capital needs, seasonal fluctuations, or unexpected opportunities.

The embedded lending market is valued at $6.35 billion and expected to reach $23.31 billion by 2031, according to industry projections. This growth signals that alternative funding isn't replacing traditional banking—it's expanding the toolkit available to entrepreneurs.

Sources cited in this article:

Defacto industry research

CRS Credit API industry analysis (2024)

iBusiness Funding research

Federal Reserve Banks' 2025 Report on Employer Firms

Canopy market research

One Park Financial official materials and FAQ

This article is for informational purposes only and does not constitute financial advice.