Why you shouldn't be afraid to invest in your business

Mon | December 2025

Fear holds more businesses back than competition ever could. According to research cited by The Zebra, more than 40% of Americans aged 25-34 said fear of failure kept them from starting a company. But for existing business owners, this same fear manifests differently—as hesitation to invest in growth, even when opportunity knocks.

The statistics tell a compelling story: According to Guidant Financials' 2025 Small Business Trends report, just over half of business owners plan to expand their current location, service, or website this year, with more than one in ten looking to open additional locations or launch new services. These businesses understand a fundamental truth: strategic investment fuels growth.

The real cost of not investing

According to research cited by The Zebra, 32.8% of small business respondents identified "lack of capital" as the primary reason their business closed—the number one factor ahead of competition, unsustainable growth, or market interest. This reveals a critical insight: businesses often fail not from over-investing, but from under-investing.

According to research cited by Cake, the main reason behind startup failure is running out of cash or failing to raise new capital, accounting for 38% of failures, followed by lack of market need at 35%. Paradoxically, the fear of investing often leads to the very outcome entrepreneurs most fear—business failure.

What successful businesses invest in

According to the Q3 2025 U.S. Chamber of Commerce Small Business Index, the majority of small businesses cite three areas as very important: marketing and sales leads at 58%, followed by the digital/online customer experience and employees/hiring talent, both at 44%. Technology/software and product development also rank highly at 43% each.

When it comes to where businesses focus most of their investments right now, marketing and sales tops the list at 36%, according to the U.S. Chamber data. This isn't coincidental—businesses that invest in visibility grow faster than those that don't.

The confidence gap is closing

There's encouraging news: business owners are feeling more confident about investing. According to the U.S. Chamber's Q3 2025 Small Business Index, 61% of small businesses rate their current access to capital as good—up 12 percentage points compared to Q1 2023 when it was 49%, and up seven points compared to Q2 2022 at 54%.

According to NEXT Insurance's Q4 2025 Small Business Forecast, 49% of business owners expect their profits to increase. More importantly, according to Guidant Financial's 2025 report, entrepreneurs aren't just talking about growth—they're putting their money where it matters, with most planning concrete expansion moves.

Technology: The democratizer of business investment

According to the U.S. Chamber of Commerce's Fourth Annual Small Business Technology Survey from August 2025, 58% of small businesses now use generative AI—18 points higher than the previous year and more than double the adoption rate from two years ago. Perhaps most tellingly, 75% of small businesses that use AI cite a positive impact on their business.

Technology investment doesn't require massive capital outlays anymore. According to Thryv's Small Business Index, 29% of small businesses say they are likely to invest in equipment and infrastructure—a 61% increase over 2023. More than a third plan to increase their technology budget.

Click the image below to watch the video and learn more.

Investment strategies that minimize risk

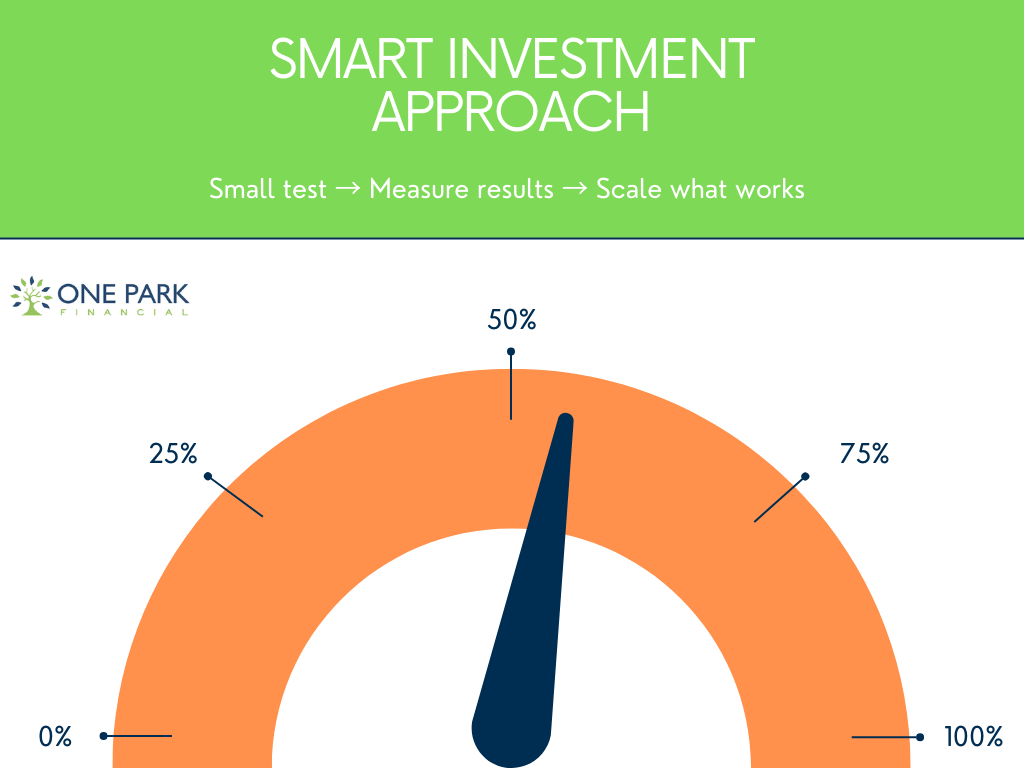

Smart business owners approach investment strategically rather than fearfully. Here's how successful businesses invest wisely:

Start with revenue-generating investments: According to industry data, investments in marketing and sales consistently show measurable returns. These investments directly bring customers through the door.

Leverage flexible financing: According to One Park Financial's materials, businesses can access working capital from $5,000 to $500,000 for purchasing inventory, covering payroll, paying taxes, or expanding operations. This flexibility allows businesses to invest opportunistically without overextending.

Test and scale: Rather than making massive investments at once, successful businesses test smaller initiatives and scale what works. This approach minimizes downside while maximizing learning.

Invest in what customers want: According to the U.S. Chamber data, younger business owners are significantly more likely than older owners to prioritize investing in digital/online customer experience—87% among Gen Z/Millennials versus 61% among Baby Boomers and older. They're following where customer behavior is heading.

The 2025 investment opportunity

According to the World Economic Forum's 2025 business forecast, "with economic recovery high on the agenda worldwide and many countries having confirmed their leaders for the next few years, we will see businesses embracing risk." The conditions for positive risk-taking are already on the horizon.

According to research by Credibly, over 53% of small business owners stated that the current state of the economy influences their decisions to pursue additional financing. However, the businesses that succeed aren't those waiting for perfect conditions—they're those investing strategically now.

Why One Park Financial matters for fearful investors

One Park Financial addresses a core fear that holds business owners back: the uncertainty of whether they'll qualify for financing when opportunity strikes. According to company materials, businesses can explore funding options without upfront fees—you "do not incur a fee to start the process or review any funding option."

The company's streamlined process provides decisions in as little as 24-72 hours, which means business owners can evaluate investment opportunities without the paralysis that comes from lengthy approval processes. Moreover, One Park Financial works with businesses that have credit scores as low as 500, removing another barrier that causes investment hesitation.

The mindset shift

According to Guidant Financial's 2025 research, motivations for business ownership are shifting, with more entrepreneurs viewing it as a long-term investment rather than just a career move. This mindset shift is crucial—when you view your business as an investment vehicle, the question isn't whether to invest, but how to invest wisely.

According to Thryv's Small Business Index, when asked what brings them the most joy from owning their own business, 48% say it has always been their dream to be self-employed. Dreams require fuel, and that fuel is strategic investment.

The businesses thriving in 2025 aren't the ones playing it safe—they're the ones investing intelligently in growth, leveraging flexible financing options, and viewing calculated investment as the path forward rather than something to fear.

Sources cited in this article:

The Zebra small business statistics (2024)

Guidant Financial 2025 Small Business Trends report

Cake small business statistics (2025)

U.S. Chamber of Commerce Small Business Index Q3 2025

NEXT Insurance Q4 2025 Small Business Forecast

U.S. Chamber of Commerce Fourth Annual Small Business Technology Survey (August 2025)

Thryv Small Business Index (2024)

World Economic Forum 2025 business forecast

Credibly small business research (2024-2025)

One Park Financial official materials

This article is for informational purposes only and does not constitute financial advice.